What to choose as a legal status for investing in real estate? Is it better to constitute an SCI or a family SARL

investment has been very successful in recent years. It is still today the first type of long-term investment required by the French with a view to building up a family estate.

Some clarification on the different possible options is certainly needed.

The stakes are high then and worth giving attention to the legal vehicle that will be used to structure it.

TABLE OF CONTENT

- What is a legal status?

- About the SCI

- About the family SARL

- About the SAS

- About the SNC

- About the status in its own name

What is a legal status?

It is quite possible to make a rental investment in a company, but you must define a specific and adequate legal status when creating the latter.

Indeed, this legal status defines the legal framework for the activity operated. It will thus have consequences at several levels:

- Its operation;

- The organization of the company;

- The choice of tax regime;

- The social system.

Different types of legal status are possible for investing in real estate: EURL, SARL, SAS, SASU, SCI or SA.

Some of these statutes are more judicious and advantageous than others, like the SCI (civil real estate company), the family SARL (family limited liability company) and the SAS (simplified joint stock company).

About the SCI

An SCI is a company whose purpose is to own a real estate portfolio with several people.

Thus, it must be made up of at least 2 partners who own the same property or the same portfolio of real estate.

The objective is to grow this common heritage, to share the income and the proceeds of the sale.

The use of the SCI is often required in order to facilitate the transmission of real estate from generation to generation by reducing the amount of transfer duties due on the inheritance. This legal form makes it possible to effectively circumvent the risks of joint ownership.

If a disagreement between partners arises, this can be overcome when the vote of the general meeting is taken. The partner who then wishes to sell his shares leaves the company if he wishes without having to force the sale of said property.

For the SCI, the choice of taxation is free. Taxed by right to income tax or IR, the SCI can decide to be taxed for corporation tax (IS).

So why choose the SCI for a real estate investment?

- Wealth management facility;

- Possibility to choose its taxation;

- Possibility of limiting shares and corporate purpose.

About the family SARL

Here is a company whose capital is held by various partners with a direct line of kinship. This concerns both grandparents, parents, children, grandchildren, but also brothers and sisters, spouses or PACS partners.

Good to know !

In a blended family, the stepchildren will not be able to enter the family SARL.

In the event of divorce, there are no more family ties, the family SARL becomes a classic SARL if the partner who is no longer part of the family remains within the company. If he leaves the company, it will remain in a family SARL.

This legal status turns out to be a solid option for renting a property and passing it on to the next generation.

The major advantage of the family SARL is the submission to income tax. Partners are taxed according to their marginal tax bracket on the income tax scale, but also in proportion to their personal contribution to the company’s capital.

This choice thus makes it possible to avoid paying corporation tax and suffering double taxation.

Why choose the family LLC?

- The liability of the partners: unlike an SCI, the liability of the partners is limited to the amount of their contributions.

- This status makes it possible to have other activities in addition to the real estate activity.

- The possibility of bequeathing, in a secure way, real estate or furniture to one’s children.

About the SAS

The simplified joint-stock company is a legal status that is very popular, especially with entrepreneurs.

Indeed, in 2019, it was estimated 63% of company creations in France were carried out in SAS.

This legal type is headed by a President who represents the company in its day-to-day management acts.

Ideal if several partners wish to exercise a commercial activity (purchase or resale of a furnished rental), the SAS is specially created for commercial activity.

Taxable with income tax at the rate of 15% on a slice of profits of less than €38,120, the SAS increases to 28% for the slice above this amount.

However, it is quite possible to opt for income tax during the first 5 years of the company’s existence.

Why choose SAS?

- No minimum number of partners required to create an SAS: a single partner can create this type of company. We then speak of a SASU for a single-person simplified joint-stock company.

- Great freedom of drafting of the statutes.

- Taxation: subject by default to IS. Possibility of choosing IR during the first 5 years of existence.

- Allows for provisions favorable to the management of a heritage.

About the SNC

The SNC, or general partnership, is an attractive choice for investing in real estate.

With this status, the partners are jointly and severally liable for all of their personal property.

The transfer of shares can only be done if all the partners agree.

The SNC applies to both a bare rental and a furnished rental.

Whatever the type of property, the manager of the SNC is considered to be an independent worker.

All the other associates have merchant status, which authorizes them to contribute.

About the status in one’s own name

Finally, the last status for investing in real estate is what it says in one’s own name, that is to say alone.

Here you do not have to resort to setting up a company.

The consequences in terms of taxation and transmission of assets should be monitored.

Concretely, when you wish in your own name, you sign the sales contract and have full ownership of the property. This is why this status is ideal for a person who wishes to become the sole owner and who wishes to keep the property for a long period.

In the event of transfer, any property acquired in one’s own name is subject to dismemberment or donation.

What legal status to invest in real estate

-

what to remember –

As we can see, there is no ideal legal status.

Depending on each situation, one model is more obvious than another. This is why it is recommended to pay particular attention to the choice of status and its characteristics in order to make a real estate investment.

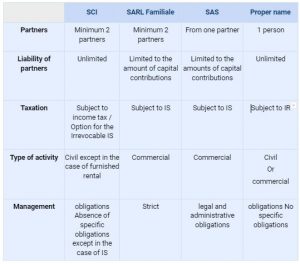

Here is a comparison table :

| SCI | SARL Familiale | SAS | Proper name | |

| Partners | Minimum 2 partners | Minimum 2 partners | From one partner | 1 person |

| Liability of partners | Unlimited | Limited to the amount of capital contributions | Limited to the amounts of capital contributions | Unlimited |

| Taxation | Subject to income tax / Option for the Irrevocable IS | Subject to IS | Subject to IS | Subject to IR |

| Type of activity | Civil except in the case of furnished rental | Commercial | Commercial | Civil

Or commercial |

| Management | obligations Absence of specific obligations except in the case of IS | Strict | legal and administrative obligations | obligations No specific obligations |