Planning to set up a French Holding company can help a lot to get a Talent Passport and to enjoy a very Tax Effective structuring when you are in France.

1 Before Coming

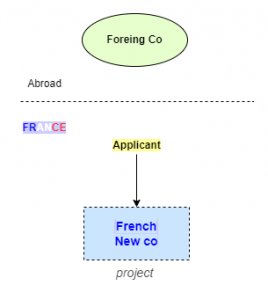

You might have a running company in your home country and wonder how to use it to help strengthen your chances to have your application approved.

Your current circumstances will look like this.

2 While Preparing

You might also consider moving your assets from abroad to France. But this is expensive, heavily tax exposed and cannot be reversed easily if you decide to get back to your native country.

Instead of moving your foreign company to France, you would be better off by setting up a new co in France and creating a synergy with this new company and your current one.

Setting up a French Company while building a credible business plan will enable you to apply for a Talent Passport as a Business Creator and enjoy the benefits of a VIP Business Visa to France.

You will make a présentation of your project in your Visa Application to the consulate.

3 When Arriving

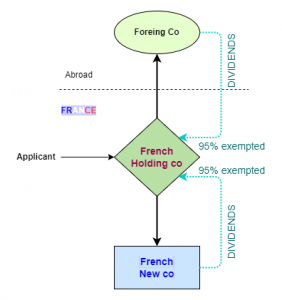

When you arrive in France, it will be time to do some structuring and create a link between your current company based abroad and the new one based in France. You will do so by setting up a French Holding company. This type of company is designed to develop links between several companies you own and benefit from tax privileges made to make this type as incentive as possible.

4 Once up & running

When your French Company and Your French Holding Company are up and running, you will be allowed to take advantage of the main features of this kind of structuring. This is how you are the French Government thanks you for creating wealth in the country that is beneficial for everyone:

> French holding companies are set up without triggering capital gains on the shares you convey ;

> And they are exempt from taxation almost entirely when they receive dividends from their subsidiaries.

95% of the dividends paid by your subsidiaries based in France and abroad will be exempt from tax.

The only condition is that dividends must come from corporate tax paying companies.

This exemption allows you to optimize your exposition to taxation and to social charges.

NEED ASSISTANCE?